Wealth Management

Where planning meets decisive execution.

Wealth Management is for clients who want their entire financial strategy actively overseen, not just reviewed. It includes the full scope of Ongoing Financial Planning, with hands-on investment management and a higher level of involvement across every major financial decision.

I am continuously engaged with your portfolio and your broader financial picture, evaluating markets, monitoring your accounts, and acting when conditions or opportunities change. Investment decisions are made deliberately, with full awareness of tax implications, cash flow needs, and long-term goals.

You are not reacting to markets or managing details. You have a dedicated partner who is paying attention, thinking ahead, and making informed adjustments as your life and the market evolve.

What’s included

Active portfolio oversight and trade execution

Continuous alignment between investments and your financial plan

Thoughtful evaluation of tax tradeoffs before decisions are made

Ongoing coordination as your priorities, income, or circumstances change

Quarterly strategy reviews to keep your Financial Blueprint aligned with your goals

A single point of accountability for your financial strategy

All features of Ongoing Financial Planning

Who it’s best for

Clients who want confidence that someone is truly watching the details

Investors who prefer decisions to be handled thoughtfully on their behalf

Those who value proactive guidance and continuity over time

The implementation discount

Commit to Wealth Management with your Financial Blueprint and receive up to $4,000* applied toward your first-year fee.

This reflects the planning work already completed and allows us to move directly from strategy into execution without duplication.

*Credit is applied against Wealth Management fees only and is not refundable. The credit will offset fees down to $0 but does not result in a cash refund.

This service is available following completion of the Financial Blueprint.

Pricing starts at $750 per quarter

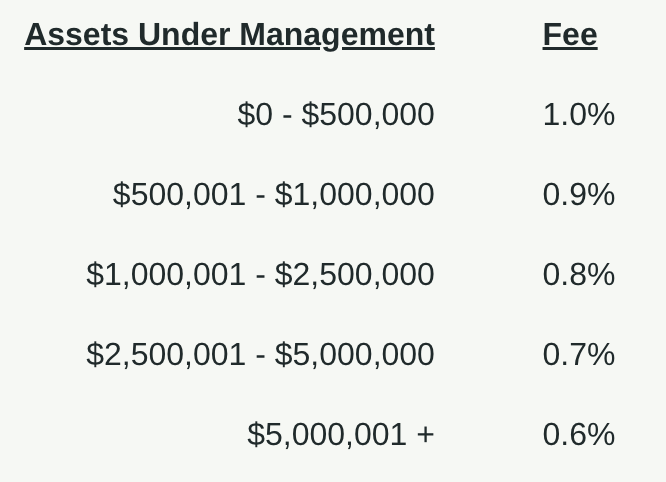

Fees are based on assets under management and billed quarterly, according to the tiered schedule below.

Assets under management include only the accounts we directly manage and exclude held-away accounts such as employer retirement plans and rental properties.

Our quarterly minimum starts at $750 and applies before any implementation discount.